Understanding Your Common Net Worth: A Look At What’s Typical

Have you ever wondered about your financial standing compared to others? It's a natural thought, really. We often look around and wonder, you know, where we fit in the grand scheme of things when it comes to money. That feeling of wanting to know what's typical, what's a common net worth, is something many people share. It's about getting a sense of where you are on your personal financial path, and that can be a big help for planning your next steps.

Figuring out what a "common" net worth actually means can feel a little tricky, though. What one person considers usual, another might see as quite different. It's not just about a single number; there are lots of things that play a part. This idea of what's shared or generally accepted, like a common understanding, applies to finances too. So, we'll look at what "common" means in the financial world and how it might relate to your own money situation.

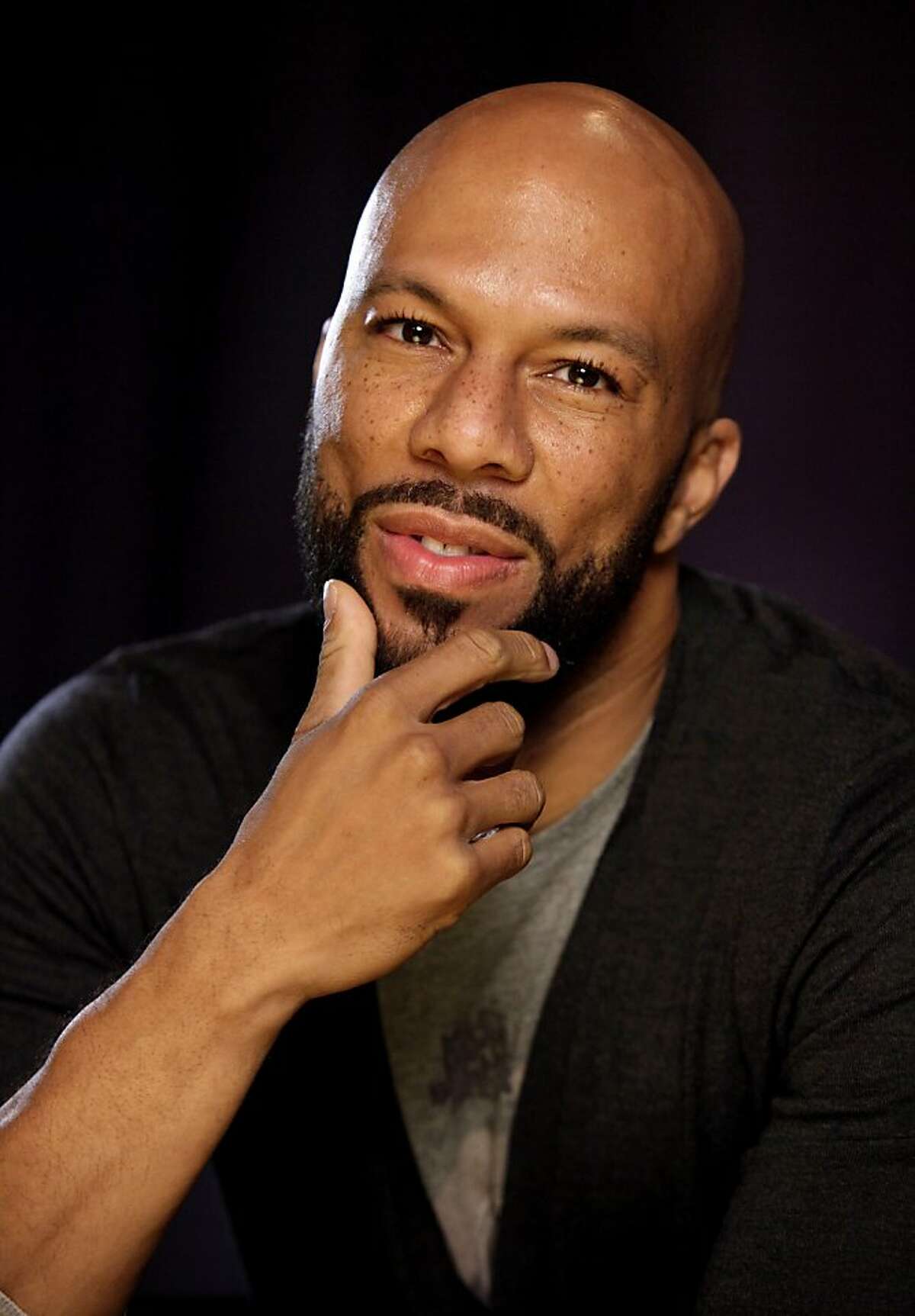

Speaking of "common," it's a word with a lot of different uses, isn't it? Lonnie Rashid Lynn, who many know as the talented artist Common, uses that name professionally. He's a remarkable American rapper and actor, with three Grammy Awards to his name, just to give you a bit of background. The word "common" itself, you see, means something that belongs equally to, or is shared alike by, two or more people or even a whole community. It's about what's typical, or what you might find in a lot of places or for a lot of people. So, when we talk about a common net worth, we're really looking at what's generally seen among many people, or what's shared by a lot of households, in a financial sense.

- Uncover The Lucrative Empire Of Boosie Badazz How He Amassed His Fortune

- Unveiling The Transformative Power Of Rebirth Tattoos Discoveries And Insights

- Who Is Druski Unlocking The Secrets Of The Comedian

- Unveiling Candy Aguilars Age Discoveries Insights Await

- Dive Into Bronwin Aurora Porn Unveiling Hidden Truths And Exploring Its Impact

Table of Contents

- Common the Artist: A Brief Biography

- What Is Net Worth, Anyway?

- What Does "Common" Mean in Finance?

- Understanding the Numbers: Average Versus Median

- Factors That Shape Your Financial Standing

- Calculating Your Own Net Worth

- Ways to Improve Your Financial Picture

- Frequently Asked Questions About Net Worth

Common the Artist: A Brief Biography

Before we get too deep into numbers and money, it's worth taking a moment to appreciate the word "common" itself, as used by the artist. Lonnie Rashid Lynn, known to many as Common, has made a big impact in music and film. He's a great example of someone who has achieved a lot in his field, and his professional name, Common, actually carries a lot of meaning, you know, about being shared or widely known. It's a name that resonates with many people.

His journey from "Common Sense" to simply "Common" shows a sort of evolution, really. It’s a good way to think about how things change and grow, even in personal finance. Just as his name became more widely recognized, the concept of a "common net worth" is something that many people want to understand better for their own lives. So, it's a nice connection, actually, between the word and its broader meaning.

Personal Details & Bio Data: Lonnie Rashid Lynn (Common)

| Detail | Information |

|---|---|

| Full Name | Lonnie Rashid Lynn |

| Known As | Common (formerly Common Sense) |

| Born | March 13, 1972 |

| Profession | American Rapper, Actor |

| Awards | Recipient of three Grammy Awards, an Academy Award, and a Golden Globe Award. |

What Is Net Worth, Anyway?

Alright, let's get down to what net worth means. Very simply, your net worth is what you own minus what you owe. Think of it as a snapshot of your financial health at a specific moment. It’s a pretty basic calculation, but it tells you a lot about your overall financial situation. This number can go up or down, you know, depending on your choices and what happens in the economy.

- John Janssen Net Worth

- Unveiling The Enigmatic World Of Black Knight Names Discover Their Secrets

- Pablo Escobars Daily Earnings Uncovering The Staggering Fortune

- Tarrares Organs Autopsied Uncovering Medical Mysteries

- Chris Youngs Height Unveiling The Country Stars Stature

What you own includes things like money in your savings accounts, investments, the value of your home, and even your car. These are called assets. What you owe, on the other hand, includes things like credit card debt, student loans, your mortgage, and car loans. These are called liabilities. So, it's assets minus liabilities, that's your net worth. It’s a straightforward idea, really, but very powerful for financial tracking.

What Does "Common" Mean in Finance?

Now, when we put "common" in front of "net worth," we’re talking about what's typical or usual for a lot of people. As "My text" explains, the meaning of common is "of or relating to a community at large," or "belonging equally to, or shared alike by, two or more or all in question." So, a common net worth refers to the financial standing that many people, or a particular group of people, share or experience. It’s not about being rich or poor, necessarily, but about what's typical across a broad group. It's a way to benchmark, more or less, your own situation.

This idea of "common" helps us understand financial norms. Gas stations became common, for instance, as the use of cars grew, you know? It's the same with financial trends. What's common changes over time and depends on many factors. So, when someone asks about a common net worth, they are often trying to find out what the typical person has in terms of assets minus debts. It’s a question about what’s generally seen or shared by a lot of people in their financial lives. This helps people feel a bit more grounded about their own finances.

Understanding the Numbers: Average Versus Median

When you look up "common net worth," you'll often see two main numbers: the average and the median. It's important to know the difference, because they tell very different stories. The average, or mean, is found by adding up all the net worths in a group and then dividing by the number of people in that group. This number, though, can be heavily pulled up by a few very wealthy people. So, it might not give you the truest picture of what's "common."

The median net worth, on the other hand, is the number right in the middle. If you lined up everyone in a group by their net worth, from lowest to highest, the median is the person in the very middle. Half the people have more than the median, and half have less. This number is usually a much better indicator of what's truly "common" or typical for most people, because it's not skewed by extreme wealth at the top. It gives you a more realistic view, you know, of the general financial picture for many households.

For example, if you have a small group where one person has a lot of money and everyone else has a little, the average might look high. But the median would show that most people have just a little. So, when you're thinking about your own common net worth, looking at the median is usually more helpful. It gives you a more accurate benchmark, more or less, for where most people stand financially. As of recent times, median net worth figures for various age groups in a country like the United States, for instance, are often reported by financial institutions or government bodies. For example, a recent report might show the median household net worth for those under 35 is X, while for those 55-64, it's Y. You can often find these figures from a well-known financial resource like the Federal Reserve or a similar government statistics site. It's a good way to see where you compare to others in your age bracket.

Factors That Shape Your Financial Standing

Your net worth, and how it compares to the common net worth, is shaped by many things. It's not just about how much you earn. Age is a big one; generally, net worth tends to grow as people get older, because they have more time to save and invest. Education also plays a part; higher education can often lead to higher earning potential, which can then lead to more savings and investments. So, that's a factor, actually.

Where you live can also make a difference. The cost of living varies greatly from one place to another, and that affects how much you can save and how much your assets, like a home, are worth. Your career choice, too, plays a role. Some professions naturally have higher incomes than others. And then there's financial behavior, you know, how well you manage your money, how much you save, and how much debt you take on. All these things come together to create your unique financial picture. It's a complex mix, really, but understanding these factors can help you make better financial choices. Learn more about on our site.

Calculating Your Own Net Worth

Finding your own net worth is a pretty simple process, and it’s a good habit to get into. First, make a list of all your assets. This includes cash in your checking and savings accounts, investments like stocks and retirement funds, any real estate you own, and even the value of your vehicles. Try to be as accurate as possible with the current market value of these things. It gives you a clear picture, you know, of what you actually possess.

Next, list all your liabilities. This means any money you owe. Think about your mortgage, car loans, student loans, credit card balances, and any other personal debts. Once you have both lists, simply subtract your total liabilities from your total assets. The number you get is your net worth. It’s a straightforward calculation, but it provides a very useful benchmark for your financial journey. You can then compare this to common net worth figures for people in similar situations to yours. It’s a good way to track your progress over time, too.

Ways to Improve Your Financial Picture

If your net worth isn't where you want it to be, or if you just want to improve it, there are several things you can do. One key step is to reduce your debt. Paying down high-interest debts like credit card balances can free up a lot of money. It’s like getting a raise, in a way, because you're saving on interest payments. This can really boost your financial health, you know, over time.

Another important step is to increase your savings and investments. Even small, regular contributions can grow significantly over time thanks to compounding. Consider setting up automatic transfers to a savings account or investment fund. This makes saving easier, almost like it's happening without you even thinking about it. Also, look for ways to increase your income, whether through a side job, asking for a raise, or developing new skills. Every bit helps, really. You can also explore strategies to increase your assets, like investing in real estate or other income-generating properties. It's about making smart choices consistently. We have more information on improving your financial health on this page .

Frequently Asked Questions About Net Worth

What is a common net worth for my age?

The idea of a "common net worth" really changes with age, you know. Younger people typically have a lower net worth, sometimes even negative, because of student loans or starting out. As people get older, they usually have more time to accumulate assets and pay down debts. So, what's common for someone in their 20s will be quite different from someone in their 50s. It's best to look at specific data for your age group to get a good comparison.

How is net worth calculated?

Calculating net worth is pretty simple, actually. You add up everything you own – your assets – like cash, investments, and property. Then, you add up everything you owe – your liabilities – like loans and credit card debt. Your net worth is simply your total assets minus your total liabilities. It's a straightforward math problem, really, that gives you a clear financial snapshot.

Is my net worth good?

Whether your net worth is "good" depends on your personal goals and where you are in life. Comparing it to a common net worth for your age and income group can give you some perspective, but it's not the only measure. What matters most is that your net worth is growing over time, and that you're making progress towards your own financial objectives. So, it's more about your personal journey than just hitting a specific number.

- Trina Net Worth

- Unveiling The Trailblazing Legacy Of Zulekha Haywood

- Unveiling Laura Davies Partner Secrets And Success Revealed

- Sasha Grey Net Worth

- Alicia Menendez A Look Into Her Family And Children

Grammys 2015: Common's' 'Nobody's Smiling' deserves rap album honor

Rapper Common gets his groove back for 'Dreamer'

Common Lyrics, Songs, and Albums | Genius